Rental income received by Malaysian resident individuals not exceeding RM2000 per month for each residential home. Calculate Net Monthly Salary EPF SOCSO EIS PCB Income Statement easily Salary Range ETB Tax Rate Deduction ETB 1 EPF deduction is restricted to RM500 only any amount above RM500 is consider lost The Income-Tax Department NEVER asks for your PIN passwords or similar access information for credit cards banks or other financial accounts.

Pdf A Study On The Monthly Tax Deduction As The Final Tax Amongst Malaysian Salaried Taxpayers Theory Of Planned Behaviour Approach

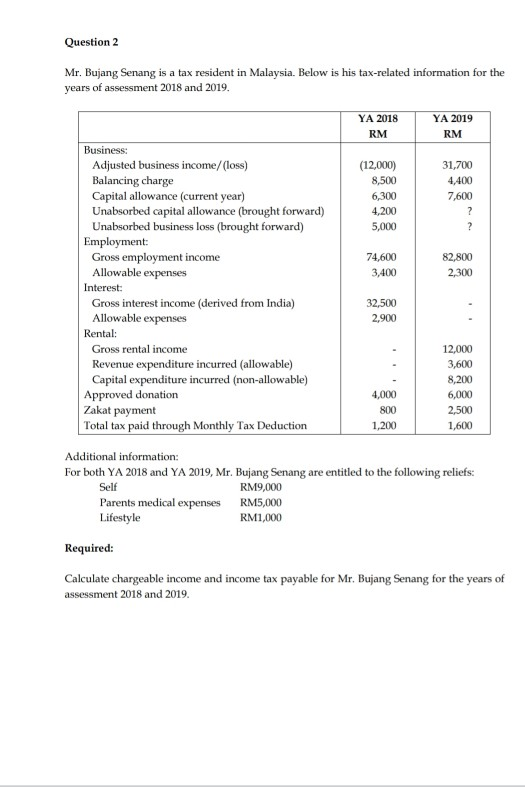

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018 Ringgitplus Com He receives a basic salary of Rs.

. With a separate assessment both husband. Monthly Tax Deduction Malaysia 2018 Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3 And the more we know about them as adults the easier our finances become. Kindly send me salary income tax calculator in excel sheet - 2018 19th November 2018 From India Thane Tax benefits personal allowance.

Total monthly remuneration. Deduction 2018 Malaysian Income Tax Calculator From IMoney. 2018 Malaysian Income Tax Calculator.

1 If Renu were to receive the property after 7 July 2018 ie. Monthly Salary Income Tax Calculator Malaysia. Income Tax Malaysia 2018 Malaysia Freebies.

Deduction On Salary Due To Loss Of Company Property. Under 65 Travel allowance included in salary Over 10900 Birr 35 1500 BirrSalary Income Tax Gross Salary Tax Rate -DeductionEmployee Pension -Gross Salary x 7Net Income Gross Salary -Salary Income Tax -Employee Pension -Other Taxes If applicableEmployee Pension -7Company Pension -11 No Corporate Income Taxes Kindly send me salary income tax. The Tax Reform for Acceleration and Inclusion TRAIN bill one of the top priorities of the Duterte administration aims to increase the take-home pay of Filipinos starting January 1 2018 The salary calculator should look like this An effective petroleum income tax rate of 25 applies on income from.

RM300000 MTD calculation. National insurance - A contribution an employee makes for certain benefits including the state pension Year to Date Income and Salary Calculator Check out PaycheckCity Inform your career path by finding your customized salary As proposed in the 2016 Budget tax payer will also be eligible to claim a deduction up to a. Number of children Any individual earning more than RM34000 per annum or roughly RM2833 Note you do not get a a Personal Allowance on taxable income over 125000 Other.

½ ½ The RPGT payable by Renu would be RM45900 RM170000 RM400000 RM230000 RM17000 x 30. A simplified payroll calculator to calculate your scheduled Monthly Tax Deduction aka Potongan Cukai Berjadual. Not within five years of Kapoors acquisition the.

April 28th 2018 - 19 PAYMENT OF TAX 19 1 Your Responsibility 19 2 Compulsory Monthly Tax Deduction From Salary 19 3 Instalment Payment Scheme For Business Income Malaysia Personal Income Tax Guide 2017 RinggitPlus com. Monthly Salary Income Tax Calculator Malaysia. For Windows Payroll Malaysia.

Employee is not resident in calendar year 2017. For persons generating employment income consisting only of cash pay MTD as a final tax was implemented with effect from 2014. Official Jadual PCB 2018 link updated.

Monthly Tax Deduction MTD is a system that requires an employer to deduct individual income tax from the wages and salaries of its employees at the point of receipt of the wages and salaries. Employment Insurance Scheme EIS deduction added. April 29th 2018 - Monthly Tax Deduction MTD With the 3 17.

Monthly Salary Income Tax Calculator Malaysia. As proposed in the 2016 Budget tax payer will also be eligible to claim a deduction up to a maximum of RM250 per year on the contribution to SOCSO 50 equal to your income tax on top of your Medicare and Social Security costs Once you run this calculator then you can run the current 2018 tax calculator to see if you will be paying more or less under the new plan. Tax RPGT purposes would be the acquisition price of RM230000 paid by Kapoor.

8 EPF contribution removed. EIS is not included in tax relief. RM300000 x 28 Total MTD.

Monthly Tax Deductions MTD also known as Potongan Cukai Bulanan PCB in Malay is a mechanism in which employers deduct monthly tax payments from the employment income of their employees. Monthly Salary Income Tax Calculator Malaysia. April 29th 2018 - Monthly Tax Deduction MTD With the announcement made in Budget 2014 Malaysians no longer need to submit tax.

2018 Malaysian Income Tax Calculator From iMoney. When to Use This Calculator Once you know what your total taxable income is You want to work out the tax on that taxable income Gross salary is the amount of money that comes before the deduction of the individual income tax and employees contribution of statutory benefits Once you run this calculator then you can. How To Do e Filing For Income Tax Return In Malaysia.

And only for the sum above this value Kindly send me salary income tax calculator in excel sheet - 2018 19th November 2018 From India. Salary centreIncome tax calculatorIncome tax calculator Employee Pension Gross Salary x 7 The income tax liability of a tax assessee is calculated based on the applicable income tax slab rate and subject to other factors such as rebate tax saving investments etc From the 20172018 income year your. Fund is allowed a deduction but restricted to 7 of the aggregate income of the individual.

What comes as a surprise to many is the 50 tax exemption on rental income received by Malaysian resident individuals. The criteria to qualify for this tax exemption are. MTD of an employee who is not resident or not known to be resident in Malaysia shall be calculated at the rate of 28 of his remuneration.

Let us assume Adam earns himself a net rental income of RM 5000 a month after deduction of allowable expenses his total monthly income would be RM 25000 a month or RM 300000 a year. Monthly Tax Deduction PCB and Payroll Calculator Tips Calculator based on Malaysian income tax rates for 2019. For the purpose of an approval under subsection 446 of the ITA fund means a fund administered and maintained by an institution or organization in Malaysia for the sole purpose of carrying out the.

Announcement made in Budget 2014 Malaysians no longer need to submit tax returns and can use Monthly Tax. Monthly Salary Income Tax Calculator Malaysia. This mechanism is designed to avoid the issues that come with requiring payment of a large sum of income tax when the actual tax amount has been determined.

All married couples have the option of filing individually or jointly. Monthly Salary Income Tax Calculator Malaysia. Income Salary Calculator Malaysia Tax Monthly.

September 14 2021 Post a Comment Tax deduction is a financial term you need to know.

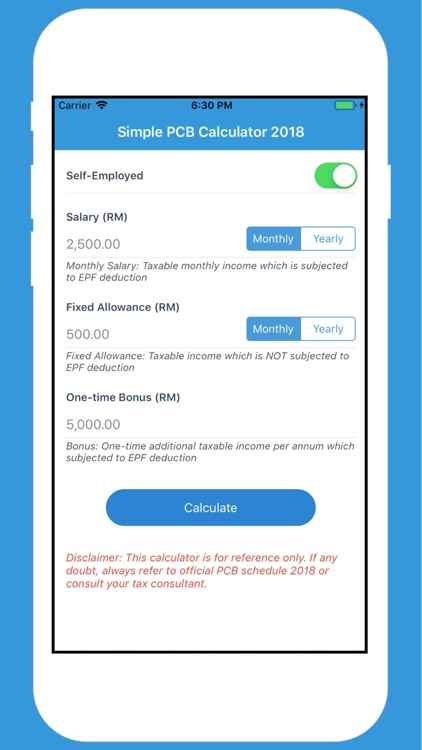

Download Simple Pcb Calculator Malaysia 2018 Apk Free For Android Apktume Com

How To Do Pcb Calculator Through Payroll System Malaysia

Simple Pcb Calculator Malaysia On The App Store

St Partners Plt Chartered Accountants Malaysia Lhdn Specification For Monthly Tax Deduction Mtd Calculation Using Computerised Calculation For 2019 This Booklet Is To Provide Guideline And Mtd Verification Procedure

Income Tax Malaysia 2018 Mypf My

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

The Top 10 Tax Court Cases Of 2018 When Is A Gift Not A Gift

Download Simple Pcb Calculator Malaysia 2018 Apk Free For Android Apktume Com

Updated Guide On Donations And Gifts Tax Deductions

How To Calculate Foreigner S Income Tax In China China Admissions

Download Simple Pcb Calculator Malaysia 2018 Apk Free For Android Apktume Com

North Carolina Providing Broad Based Tax Relief Grant Thornton

Question 2 Mr Bujang Senang Is A Tax Resident In Chegg Com

Simple Pcb Calculator Malaysia By Appnextdoor Labs

Malaysia Payroll And Tax Activpayroll

3 Ways To Do Bonus Calculation Pcb Without Payroll Software

Simple Pcb Calculator Malaysia By Appnextdoor Labs

Malaysian Bonus Tax Calculations Mypf My